Why is your Mortgage Credit Score lower than your Free Credit Score? We constantly see…

Credit Score and Getting A Home Loan

What are the minimums for credit score?

While higher scores will make the whole loan process easier, having a lower score does not eliminate you from loan eligibility. The two most common types of loans are Conventional and FHA. They both have their own characteristics, but how does credit effect each differently?

Conventional

If pursuing a Conventional loan, you will need to be on top of your credit. Typically conventional loans are the best fit for a score of 680 or higher. This means your history will need to have almost zero blemishes. You may be able to qualify with a lower score but your interest rate and costs will be higher. At that point, you are better off going with a different loan product.

FHA

When your scores are lower, a FHA loan is a great product to get you into a home. The minimum score for a FHA loan is 500 with 10% down, or 580+ with 3.5% down. Many lenders, typically larger companies, will not accept scores under 620 for a FHA because they do not do manual underwrites, which makes the file more difficult to close and in that case, it is better to seek out an Independent Broker. The bottom line, having a low score does not eliminate you from qualifying for a loan. This does not mean you should neglect your credit. FHA loans are there to help those with low scores but they also require your recent credit history to be in decent standing.

Why Does Credit Matter?

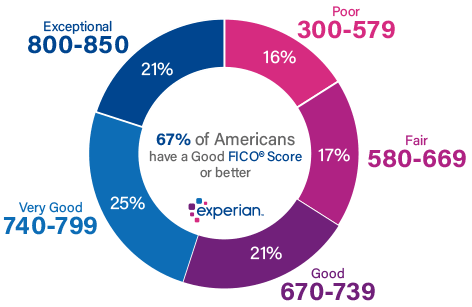

Credit shows the lenders what type of borrower you are. Your score will then direct you towards which loan product if best for you, but what shows up on your credit report is more important. Consumer credit scores can be lower for many different reasons. You could have two low score borrowers and the one with a lower score may actually qualify while the other score does not. Why is that?

For example…

600 Score Borrower: Pays bills on time, but their credit cards are maxed out which lowers the score.

620 Score Borrower: Cards have low balances, but they have multiple late payments recently which has brought their score down.

The 600 score borrower pays their debts on time and thus shows their ability to make their debt obligations. The other shows their inability to pay their debts on time. The lower score will have a better shot at getting approved for a loan.

Credit History

- Instead of going through the pain of waiting longer and holding up the process, be proactive and make sure your credit history and score are where they should be before approaching a home loan. You do not know what is hurting your score unless you actually check it. Get your credit report at no cost from the three national credit bureaus so you can look for anything that may be causing issues. Those three bureaus are Experian, Equifax, and TransUnion.

- If you find any inaccuracies, be sure to dispute them to the bureaus in writing. You will need to provide any evidence or records you have in order to support the dispute.

- If you have any personal inflicted credit issues, the FHA recommends those applicants should get help from a Credit Counseling Program which will get you back on track. You can also repair your credit yourself by paying off any late payments and settling any collections you may have. Once you have paid off and settled these issues, you want to let your credit go through a few cycles so you give yourself some time for your scores to increase.

- There are extenuating circumstances like job loss, injury, or others that may have prevented you from paying off debts in a timely manner. Those circumstances will be taken into account, however, if you show that you have neglected payments of debt with no reason, your chances of getting a loan are not good.

- In the end, if you’re planning to buy a house, and your score doesn’t meet the minimum, you should weigh the advantages and disadvantages of putting down a larger down payment or using those funds to try and improve your score first.