Buying your first home is a big step, and for Ohio residents, there are plenty…

Tips for First Time Home Buyers

As a First Time Home Buyer, it can be intimidating, challenging, and confusing. There are many things that go into acquiring a loan for the home of your dreams, however, most of them are not common knowledge. Lets talk about some simple but very important steps that will help you save money on acquiring your home loan. Here I will provide some tips for first time home buyers.

Assess your situation.

1. What is the maximum monthly payment you can afford?

Your debt-to-income ratio will give you a price range of what you can afford. In other words, know your gross MONTHLY income and your TOTAL MONTHLY debts showing on credit (i.e. car, credit card, etc. payments) to provide to your Mortgage Broker or lender. Generally, to qualify for a mortgage, monthly payments on your debts should come to no more than 43% of your monthly income.

2. What is your credit situation?

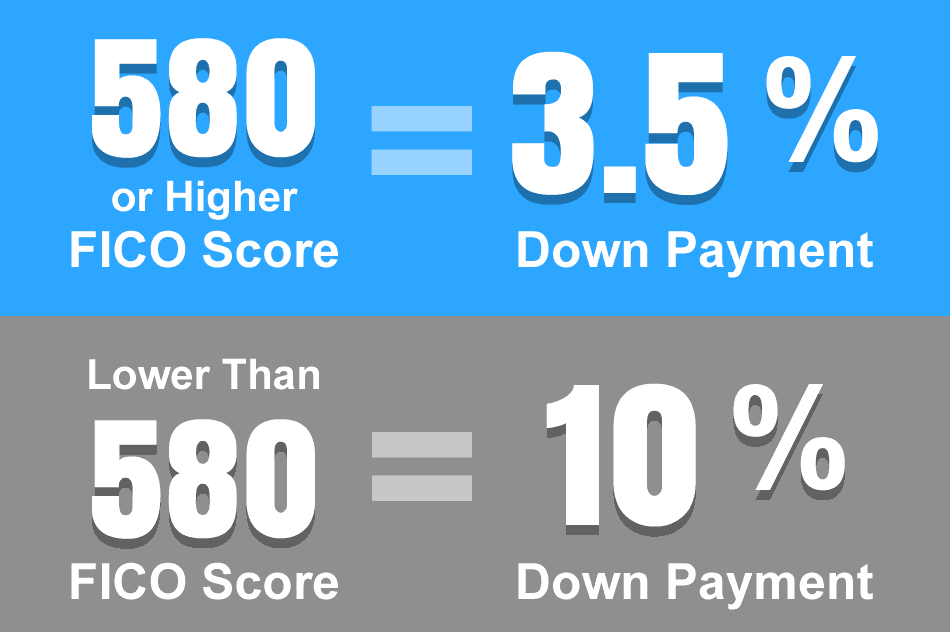

If your score is low, why is it low? Your credit score will determine the possible loan amount and interest rate you may receive. (CHECKING YOUR CREDIT SCORE FOR A MORTGAGE LOAN DOESN’T HURT IT). While larger companies (banks, etc.) will not give out loans to anyone with a score of 620 or lower, Independent Brokers are able to get loans done when scores are lower than 620. This is because Brokers can put loans through a manual underwrite while the larger companies need them automatically accepted. This does not mean you should be careless with your credit score. Understand that the lower your score the worse your loan situation will be.

3. Are you expecting any upcoming big changes in your life?

Incurring any large payments soon? Buying a car? Getting married? Having a child? Switching jobs? Not only that but assess where you are headed! Understanding that your finances will change from simply just rent and utilities ; you now must prepare for things like heating and cooling, insurance, waste removal, emergency repairs, etc. Think not only of now but of what may be around the corner. Be prepared!

Do your research.

1. Don’t go to just one lender.

Compare offers from several different lenders. Look into pairing with a mortgage broker, as they can often offer more diversified lending options. Above all, a mortgage broker might be able to offer you a different type of loan from the conventional loans offered by most banks and lenders.

2. Know your limits.

This goes back to knowing what is the maximum monthly payment you can afford. In other words, become pre-qualified for a loan before you begin your home search. Getting a pre-qualification will give you an accurate number of what you can actually afford which will help narrow down your search and help you avoid falling in love with a home that is simply out of your range.

Use some of these helpful tips if you are first time home buyer and go find yourself the home of your dreams!