Buying your first home is a big step, and for Ohio residents, there are plenty…

Title: Unlocking the Path to Financial Freedom: A Guide to Credit Repair

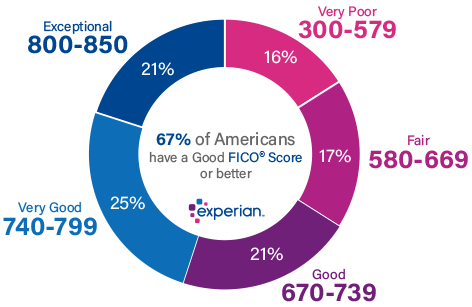

In today’s financial landscape, a healthy credit score is a crucial asset, opening doors to better interest rates, loan approvals, and overall financial well-being. If you find yourself on the journey to credit repair, understanding the factors influencing your credit score and implementing strategic actions can make a significant difference. Let’s delve into the key components of your credit score and actionable steps you can take to boost it.

Understanding Your Credit Score Calculation:

1. Payment History (35%):

- Timely payments on credit accounts, loans, and bills are essential.

- Late payments, defaults, and bankruptcies negatively impact your score.

2. Credit Utilization (30%):

- Maintain a low credit card balance relative to your credit limit.

- Aim for a credit utilization ratio below 30% to positively impact your score.

3. Length of Credit History (15%):

- The longer your credit history, the better for your score.

- Avoid closing old accounts, as it can shorten your credit history.

4. Types of Credit in Use (10%):

- A diverse mix of credit types (credit cards, mortgages, installment loans) can be beneficial.

- Be cautious about opening new accounts frequently.

5. New Credit (10%):

- Opening multiple new credit accounts in a short period can be perceived as risky.

- Space out new credit applications to minimize negative impact.

TALK TO AN EXPERT ON YOUR CREDIT REPAIR

Proactive Steps to Improve Your Credit Score:

1. Obtain and Review Your Credit Report:

- Request a free annual credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion). Or here’s another option.

- Check for errors and dispute any inaccuracies promptly.

2. Develop a Payment Schedule:

- Set up reminders or automatic payments to ensure bills are paid on time.

- Consistent, timely payments are one of the most effective ways to boost your score.

3. Reduce Credit Card Balances:

- Create a plan to pay down high-interest credit card debt.

- Aim to keep credit card balances below the recommended 30% of your credit limit.

4. Avoid Closing Old Accounts:

- Closing old accounts can shorten your credit history, potentially lowering your score.

- Keep old accounts open, even if you don’t actively use them.

5. Negotiate with Creditors:

- If you’re struggling to make payments, consider negotiating with creditors for a more manageable payment plan.

- Many creditors are willing to work with you to avoid defaults.

6. Diversify Your Credit Mix:

- If possible, diversify your types of credit (e.g., credit cards, installment loans).

- A well-rounded credit profile can positively influence your score.

7. Be Cautious with New Credit Applications:

- Limit new credit applications, especially within a short timeframe.

- Each application generates a hard inquiry, which can temporarily impact your score.

By understanding the factors influencing your credit score and implementing these proactive steps, you can set yourself on the path to credit repair and financial success. Remember, patience and consistency are key on this journey toward a healthier credit profile.

Do you think you are ready to get pre-approved for a home loan? Get started here!